How To Get Car Insurance So Cheap It’s Almost Free

[wpdts-month-name] [wpdts-day], [wpdts-year]

Why Did No One Tell California Drivers About This?

Did you know, if you have no DUI and live in a qualified zip code you could qualify for a high discount on your car insurance. Additionally, depending on your age you could qualify for even higher discounts.

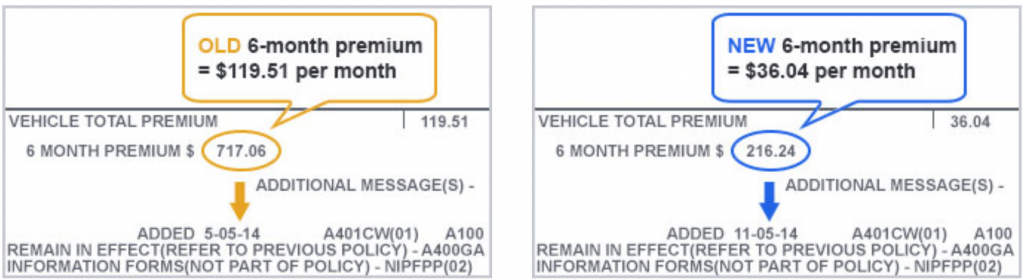

Many drivers have turned to popular online services finding discounts and policies as low as $36/month.

Here’s How You Do It:

Step 1: Tap your age below to match additional discounts.

Step 2: Once you enter your zip code and go through a few questions, you will have the opportunity to be matched with top carriers in your area for a possible average savings of $531/year.

THIS IS AN ADVERTORIAL AND NOT AN ACTUAL NEWS ARTICLE, BLOG, OR CONSUMER PROTECTION UPDATE

This website is a market place. As such you should know that the owner has a monetary connection to the product and services advertised on the site. The owner receives payment whenever a qualified lead is referred but that is the extent of it. This is an advertisement and not a news article, blog, or consumer protection update. *Clarification of the advertising headline “New Tip in South Carolina”. – Merriam-Webster’s Dictionary defines the word “Tip” as “a piece of advice about the best way to do something”(http://www.merriam-webster.com/dictionary/Tip). This article aims to advise the public that comparing rates is one of the best ways that you can save money on car insurance. No matter what city, state or zip code you live in you can compare rates and get free quotes. If you truly want to find the best rate and save on car insurance then follow our advice or “Tip” to compare rates. Here is a link to a survey which demonstrate the importance of comparing rates and how applying this “Tip”, in any state city or zip code, can help drivers save 32% and $368 per year. A second survey which analyzed car insurance quotes for 1,000 zip codes across the U.S. found that within a given zip code, rates vary by 154% on average, allowing drivers to find an average of 32% and $368 per year in savings.